Enterprise 5G Benefits

IOT & Connectivity

Software Engineering

Enterprise Verticals

Blogs

22 December 2021

This article appeared on The Edge on 20 December 2021.

IF you want different results, do things differently. The fact is that Malaysia cannot be happy that its average mobile broadband speed is a fraction of those at the Asian Tiger economies (South Korea, Taiwan, Hong Kong and Singapore). People in these countries and their leading industries and businesses are already innovating and benefitting from having superior 5G connectivity on top of better fibre connectivity.

This is precisely why a single wholesale network was proposed in March to accelerate the rollout of 5G, or the fifth generation of cellular network, in Malaysia under the Ministry of Finance (MoF)-controlled Digital Nasional Bhd (DNB). If you are not satisfied with your existing mobile network quality, you should be in favour of this change, as the amount of investment needed to keep up and improve network quality will go up even more if data usage continues to explode as it did in recent years.

Whether it is the natural tendency to protect the status quo or otherwise, the public now knows that the country’s big mobile carriers are pushing for a second 5G provider — nine months after DNB was set up, five months after Swedish telecommunications giant Ericsson was named DNB’s 5G development partner and just days before the 5G network went live in Putrajaya, Cyberjaya and parts of Kuala Lumpur.

A Reuters report headlined “Malaysia telcos call for second 5G provider, sources say” was released the evening before 5G was scheduled to go live the morning of Dec 15.

Those in the know already knew the proposal to be why the Cabinet is reassessing the 5G rollout plan. Communications and Multimedia Minister Tan Sri Annuar Musa announced the potential U-turn on DNB and the single wholesale model for 5G on Dec 7, barely a month after he witnessed (on Nov 10) the integration of DNB’s Multi-Operator Core Network (MOCN) with five mobile operators (the sixth, Yes, was underway back then) — the same day an earlier Nov 10 Reuters article headlined “No takers for Malaysia’s 5G plan as major telcos balk over pricing, transparency” brought underlying resistance on the DNB model into the open.

Higher 5G costs if shared by two, not six

What the article published by Reuters last Tuesday did not say was that a Cabinet decision to allow a second 5G provider would effectively diminish the cost and coverage benefits of the single wholesale model under DNB. While DNB officials had not publicly acknowledged this, it is an open secret to anyone who is familiar with how the maths work under the single wholesale model, where cost benefits are largely derived from removing infrastructure duplication.

One does not need to be all that smart to know cost per mobile network operator (MNO) using DNB’s 5G network would be higher if only two players — Telekom Malaysia Bhd’s Unifi Mobile and YTL Communications Bhd’s Yes — share the rollout cost of 5G without Maxis Bhd, U Mobile and Axiata Group Bhd’s Celcom, which is merging with Digi.Com Bhd.

Only Unifi Mobile and Yes have taken up DNB’s free access to the 5G network through end-March 2022. At the time of writing, none have officially signed a long-term deal to take 5G wholesale capacity from DNB since pricing is still being worked out.

The alternative that the larger telecoms operators want and have proposed to the powers that be is basically maintaining the status quo.

Why not keep status quo?

Having the most to lose because they have spent the most on the existing telecoms network infrastructure and have a sizeable mobile user base, the larger operators want to be allowed to build their own 5G network, just as they have done with all the previous generations of cellular networks. They are even offering to share the “alternative” 5G network among themselves in order to be allowed to continue giving out multibillion-ringgit infrastructure contracts instead of just incurring operating expenditure from buying 5G capacity from DNB, which has said total rollout cost for 5G would be easily double the projected RM16.5 billion if the operators were to do it themselves.

The problem with allowing telecoms operators to own the 5G network infrastructure before rollout is complete is that maintaining the status quo is far from adequate for the country’s development, and has not delivered fast enough broadband speeds for most Malaysians, a seasoned observer says.

Why not just give the telcos the 5G spectrum and make them promise to deliver on an aggressive 5G rollout timeline?

“Would Malaysia really get 5G as fast [without DNB] or would telcos maintain the status quo by paying a fine they can well afford?” the seasoned observer asks. “By that time, the country would have lost time [in the global 5G race].”

All or nothing

The bottom line is that DNB’s single wholesale network model means operators would likely need to accelerate the depreciation of existing telecoms infrastructure in their respective books, be forced to take up 5G capacity in all areas that DNB rolls out to even if there is no near-term commercial feasibility and be forced to compete on service quality and product innovation instead of network quality.

“It’s like having one large highway with different modes of payment — Touch ’n Go, SmartTAG and RFID — offering different convenience from cash previously but everyone is on the same big highway instead of different players building different highways,” an industry executive says.

DNB’s model requires the government to be firm about having only one 5G network to derive the maximum cost benefit for the country and mobile phone users.

Some monopolies make sense

None of the Asian tiger economies adopted a single 5G wholesale network, so why must Malaysia have a monopoly?

If Malaysia is fiscally rich, developed, well planned out and as small as Singapore, we wouldn’t be having this discussion. And we wouldn’t be having this discussion if everyone was happy with the cost, speed and reliability of the country’s mobile broadband connection.

The fact is that with DNB’s model, Malaysia’s government, via the MoF-controlled DNB, will own the valuable 5G network infrastructure that all operators need in order to offer 5G services and without having to take up huge debt.

In fact, any debt taken is only bridging financing because DNB’s 5G network is to be paid for using securitised cash flow from its clients — the mobile operators taking up the 5G wholesale capacity from a not-for-profit-driven government-controlled entity because there is no alternative 5G network.

This is only possible because of how valuable 5G spectrum is to deep-pocketed potential customers (telcos) that need to balance shareholders’ interest (consistent dividend payments) with the need to invest to serve their customers (end-users).

Why would the government give up the leverage it has in the telecoms operators’ need of 5G spectrum to offer 5G services?

Consumers are the primary beneficiaries when the government prioritises their interests and the country’s need to build critical infrastructure fast.

While DNB, like 1Malaysia Development Bhd (1MDB), also comes under MoF Inc, and politicians are rightly calling for greater parliamentary scrutiny, the two entities are vastly different.

The greatest difference is that DNB will effectively own valuable 5G asset while having zero debt — if its securitisation model under the single wholesale network is allowed to work — because it will be the telcos that will be paying for the use of 5G network that DNB will own. Again, that is possible because all the 5G spectrum is parked under the government-owned entity and the telcos will be forced to buy 5G capacity from the government if they want to offer 5G services to end-users, because there is no alternative.

Conversely, The Edge had previously reported that 1MDB took on sizeable debt and overpaid for “assets”, some of which remain unrecoverable today. Thanks to investigations by leading global regulators, including the US Department of Justice and Switzerland’s financial regulator, the world is aware of the money stolen from 1MDB.

The reason that Malaysia needs to build only one 5G network is the same as the need for only one North-South Expressway. Malaysia already has “smaller alternative roads” to the North-South Expressway in the form of the 4G network.

What would really be shocking is if part of the 5G spectrum was quietly given to little-known privately owned firms alongside established telecoms operators — which was what happened in the mid-2020s, a decision that was quickly reversed.

For the sake of argument, why not use the Universal Service Provision (USP) fund to expand 5G coverage and just continue to give the 5G spectrum to the telcos?

The USP fund has been in existence since 2002 under the Malaysian Communications and Multimedia Commission (MCMC), where licensees have to contribute 6% of weighted net revenue from designated services every year. Between 2003 and 2020, annual contributions ranged from RM512.1 million in 2004 to RM1.98 billion in 2018, averaging RM1.18 billion.

As at end-2020, the USP fund had RM10.09 billion accumulated funds, money that is already being earmarked to bridge the country’s digital divide under the Jendela initiative.

Why reject the DNB model that forces telecoms operators to share the cost of rolling out 5G to areas that may not be financially feasible to them when it does not cost the government any money to do so?

This is good from the country’s perspective in several aspects, including bridging the development gap in the regions that would otherwise have had to wait much longer for 5G connectivity. If there is a “losing” party, it would be the telecoms operators, whose interest should not come ahead of the country’s strategic infrastructure development and the people’s ability to get 5G sooner and at more affordable prices.

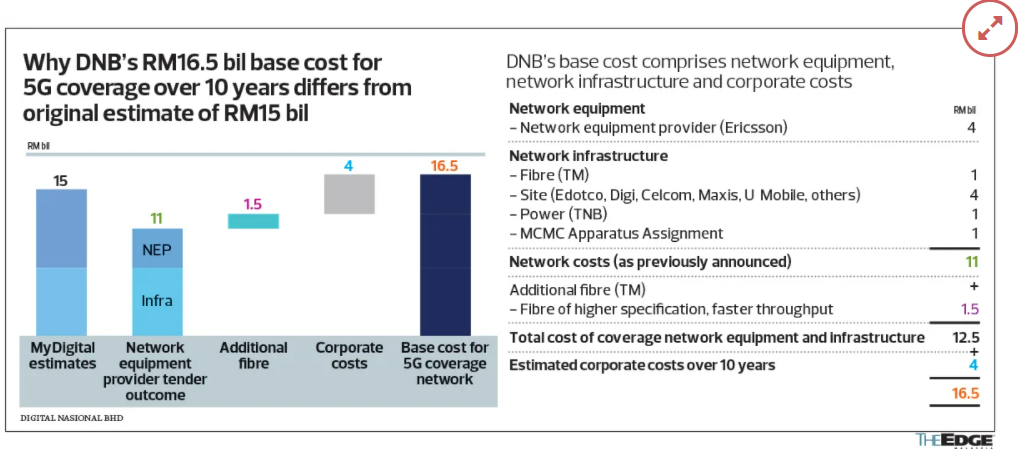

As for the confusion over what exactly is the breakdown of DNB’s cost of rolling out 5G, DNB explained that the RM16.5 billion it mentioned is not just for network equipment and infrastructure but also includes the cost of renting fibre capacity, power, as well as RM4 billion in corporate costs over 10 years (see table). According to estimates provided by DNB, of the RM11.5 billion total cost of coverage and network infrastructure, some RM9.8 billion or 85% will benefit Malaysian interests — including RM7 billion or 61% for bumiputera interests. The Malaysian government, through MCMC, will also receive RM1 billion in fees from apparatus assignment, DNB adds.

If DNB’s transparency is in question, the setting up of a parliamentary select committee to oversee execution would further lend credence to its model.

After Malaysia achieves 80% 5G coverage in 2024, it is understood that telecoms operators can and will be invited to take up a stake in DNB alongside institutional fund managers. By then, the country should already be reaping the benefits of an accelerated 5G rollout. The right decision on 5G would show the world the country’s determination and ability to leap forward despite tougher developmental circumstances.

General Media Contact corp.comms@digital-nasional.com.my

Stay tuned for the latest news from us